Negotiating mining agreements is almost inevitable in Australia, where mineral resources and Native Title co-exist. Fortescue Metals Group (FMG) and the Yinjibarndi Aboriginal Corporation (YAC) have been in conflict over a land use agreement for the past four years. This is due to a unfair agreement that has resulted in the divide in the Yinjibarndi Native Title holders. So this raises the question, are mining agreements between Native Title and mining companies fair and effective?

Until the 1990s mineral development denied Aboriginal People a say over mining on their traditional lands, leaving them to deal with the social and environmental impacts (O’Faircheallaigh, 2007: 26; O’Faircheallaigh, 2008: 25). Within the last fifteen years, legal policy and institutional forces have changed how mineral development occurs on Aboriginal land, most especially the Native Title Act 1993 (NTA). This, and many other various acts and legislation have led major mining companies to negotiate with Aboriginal Traditional owners (O’Faircheallaigh, 2008: 25). An example of this is the Fortescue Metal Company verses the Yinjibarndi Aboriginal group in the Pilbara region.

Fortescue Metal Group is a multi billion dollar company, responsible for the fourth largest iron ore producer in the world. In 2011, the area known as the ‘Solomon Hub’ was proposed for an extension on the already existing mine. More than three billion tonnes of resources have been identified at Solomon Unfortunately for the Fortescue Metal Group the area is not only mineral rich but also rich in Aboriginal cultural heritage (Wells, 2013: 20).

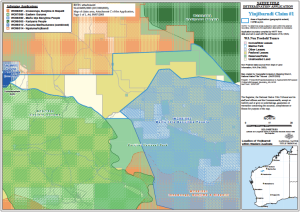

The Yindjibarndi hold non-exclusive Native Title with Ngarluma in respect of a large tract of the Pilbara west of Port Hedland (Wells, 2013: 20). They are also under application for another Native Title claim over a further 2, 788 square kilometres (Wells, 2013: 20). The NATIVE TITLE ACT regulates the way in which mining and other activities take place in an area with a registered Native Title claim. Native Title parties have no right of veto over a future act, and are instead accorded rights to negotiate over future development or a ‘future act’ (Burnside, 2008: 54). The right to negotiate must be done before a future act can be done. The negotiations take place within a six-month period between the government, the Native Title party and the grantee (mining company) in which they reach an agreement about the act. Within this negotiation time, rejection of the act and compensation offers are finalised (Burnside, 2008: 55).

In the case of the Yinjibarndi Aboriginal group, a meeting was held with Andrew Forrest, the CEO of FMG, and an offer of $10 million per year was made, $4 million in royalties and $6 million in community development. The offer was rejected by the YAC, asking for four times that amount, in keeping with the compensation being offered by other major mining companies in the Pilbara. Rio Tinto offers royalties of 0.5% of profits made whereas Fortescue Metal Groups fixed payment of $4 million is only 0.057% of the mines income each year. FMG is known for their cost-cutting measures, spending a little as possible to ensure the greatest turnover (Wells, 2013: 21). Michael Woodley, one of the head spokesmen of the YAC, believed the request for a higher compensation was justified because the project will not only damage their traditional land and religious sites but also the people themselves. Michael stated ‘Ceremony, kinship and tribal law are the heart and soul of our life, they connect us to the beginning of the world’.

The Yindjibarndi Native Title Claim Area

The Yindjibarndi Native Title Claim Area

A breakaway group of the Yinjibarndi community, the Wirrlu-Murras, supported the compensation and the work of FMG. During the negotiation meeting between the Yinjibarndi people and FMG, a unanimous vote was made to take the compensation offer, but this was only because when voting counted, the YAC had already left the meeting. A member of the breakaway group argued that the offer was more reasonable, as it also provided opportunities for education, jobs and training.

So the difficult question remains, who is right in this scenario? Both parties just want the best for their communities.

Many onlookers and the media make judgement on the effectiveness of negotiated mining agreements. In an interview with Michael Woodley, he was told about other situations where Aboriginal communities had received compensations and the money had been spent unwisely. Woodley replied, ‘We have an organisation with a very sound structure. You are talking about negotiating on a fair and equal platform. We did that for the past three years.

In April last, Federal Court ruled the YAC the legal traditional owner representatives in the ongoing Pilbara mining dispute. If FMG or any other resource company wants to negotiate with them, they have to talk directly with the YAC. FMG still have a tenure contract in the area on already approved mining sites. So the worry is that due to the bad blood between YAC and FMG, the next ten years of working together might be difficult.

Michael Woodley celebrating the Federal Court win that has legally recognised the Yindjibarndi Aboriginal Corporation the only group permitted to represent as the Traditional landowners on the behalf of the community.

Many academic commentators have discussed the issue of mining agreements. O’Faircheallaigh (2005) states that negotiation positions reflect the various legislative enactments, in particular the weak bargaining position of the Aboriginal Native Title landowners.

Unfortunately the Native Title act can put Aboriginal groups in a weak position, as they cannot prevent development, if they are unable to negotiate an effective agreement to protect their cultural heritage. Indigenous groups are put under enormous pressure to negotiate a compensation based agreement, on the value of the minerals and the profits even if they are dissatisfied with the level of cultural heritage protection (O’Faircheallaigh, 2007).

There is a minority of agreements that do deliver substantial benefits. This is usually based on the mining company’s policies and practices (O’Faircheallaigh, 2007). Some companies are committed to a long-term relationship with Native Title groups, they do not use negotiation as a bargaining tool and instead provide an equal playing field and negotiation equitable outcomes (O’Faircheallaigh, 2007). Therefore we can only hope that all mining companies take this approach to ensure a fair playing field when negotiating mining agreements.

Reference List

ABC News 2013 Yinjibarndi court decision brings ‘tears of joy’. Retrieved 2nd September 2014 From: http://www.abc.net.au/news/2013-02-14/yindjibarndi-court-decision-brings-tears-of-joy/4519098

ABC North West WA 2011 Dispute over Fortescue Aboriginal compensation deal. Retrieved 2nd September 2014 From: http://www.abc.net.au/local/stories/2011/04/15/3194734.htm?site=northwestwa

Burnside, S. 2012. Outcomes for all? Overlapping Claims in Intra-Indigenous conflict under the Native Title Act. Australian Indigenous Law Review 16(1): 2-14

Fortescue Metals Group 2014 Solomon Hub. Retrieved 4th September 2014 from: http://www.fmgl.com.au/our_business/Solomon_Hub

Mining Australia 2011 WA Aboriginal community reject $10million per year for land rights. Retrieved 2nd September 2014 From: http://www.miningaustralia.com.au/news/wa-aboriginal-community-reject-10-million-per-year

Native Title Register – Yinjibarndi claim # 1. Retrieved 8 October 2014 From: http://www.nntt.gov.au/searchRegApps/NativeTitleRegisters/RNTC%20Extracts/WC2003_003/WC2003_003%201.%20Map%20of%20claim%20area.pdf

O’Fairchaellaigh, C. 2007. Native Title and Mining Negotiations: A Seat at the Table, But No Guarantee of Success. Indigenous Law Bulletin. 18

O’Faircheallaigh, C. 2008. Negotiating Cultural Heritage? Aboriginal-Minging company Agreements in Australia. Development and Change. 39(1): 25-51

Wells, D. 2013. The Naitve Title System as Market: Fortescue Metal Group and the Yinjibarndi. Indigenous Law Bulletin 8(4):20-23